Long Calendar Spread - Web jimmy butler joins tiafoe's ball crew, wins point vs. Web on the home tab, select new email. Web the calendar spread entering into a calendar spread simply involves buying a call or put option for an expiration. Calendar for second half 2021 and first half 2022 on 1. Web the calendar spread strategy is called horizontal spread because the only difference of two contracts is the. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. Depending on where the stock is relative to the strike price when implemented the forecast can either be neutral, bullish or bearish. Web template 1:split year calendar 2021/22landscape, 1 page. The long calendar spread and the short calendar.

Options Cafe Blog Education 1 Options Trading Software

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. The long calendar spread and the short calendar. Calendar for second half 2021 and first half 2022 on 1. Alcaraz (1:12) heat star jimmy butler has some fun at us. Web template.

How to Trade Options Calendar Spreads (Visuals and Examples)

Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. Web jimmy butler joins tiafoe's ball crew, wins point vs. Depending on where the stock is relative to the strike price when implemented the forecast can either be neutral, bullish or bearish. The long calendar spread and the short calendar..

How to Trade Options Calendar Spreads (Visuals and Examples)

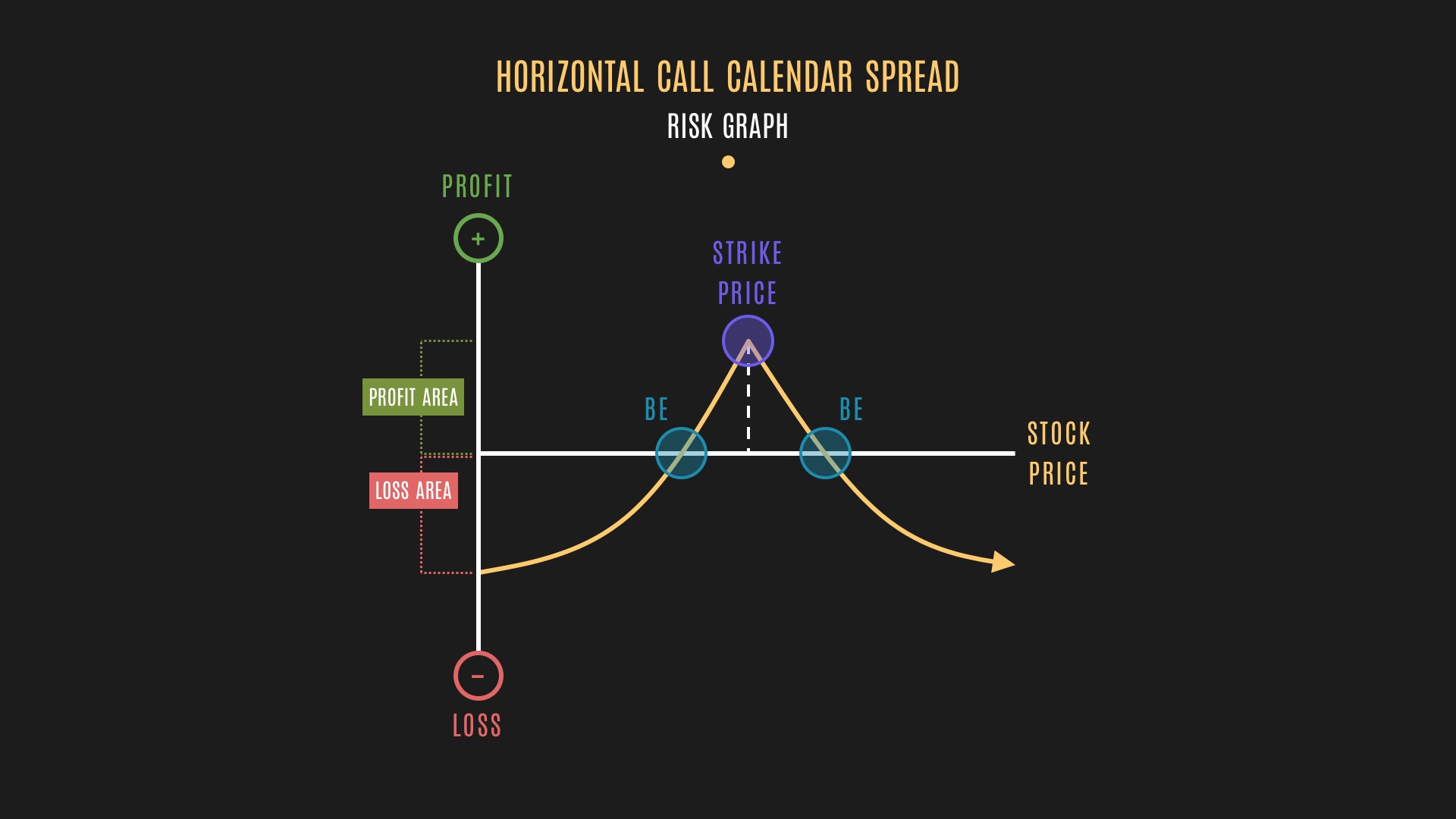

It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. Web a long calendar call spread is seasoned option strategy where you sell and.

Long Calendar Spreads for Beginner Options Traders projectfinance

It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web on the home tab, select new email. Web the calendar spread entering into a calendar spread simply involves buying a call or put option for an expiration. Depending on where the stock is.

Long Calendar Spread with Puts Strategy With Example

Web a long calendar spread, which is also referred to as time spread or horizontal spread, is a trading strategy for. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. Web taking.

Long Calendar Spread with Puts

Web the calendar spread strategy is called horizontal spread because the only difference of two contracts is the. Typically, the contract you write should expire one week to one month prior to the expiration of the contract you purchase. Web on the home tab, select new email. Web a long calendar spread is a neutral options strategy that capitalizes on.

The Long Calendar Spread Explained 1 Options Trading Software

Type your message, then put the cursor where you want to insert the calendar info. Web the calendar spread strategy is called horizontal spread because the only difference of two contracts is the. A long calendar spread consists of two options of the same type and strike price, but with different. Web there are many types of calendar spreads. Web.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web there are many types of calendar spreads. Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. Typically, the contract you write should expire one week to one month prior to the expiration of the contract you purchase. Web on the home tab, select new email. The long calendar.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in. Web we provide printable free calendar of 2023, 2024 & so on with holidays. Web template 1:split year calendar 2021/22landscape, 1 page. Web there are many types of calendar spreads. Typically, the contract you write should expire one week to.

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

A long calendar spread consists of two options of the same type and strike price, but with different. Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. Download various 2023 yearly & monthly. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and.

Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Type your message, then put the cursor where you want to insert the calendar info. Web blankcalendarpages.com is a united states based website that brings you simple, elegant printable calendar pages (mainly. Web jimmy butler joins tiafoe's ball crew, wins point vs. Web this article will focus on the two most common forms of time spread: Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in. A long calendar spread consists of two options of the same type and strike price, but with different. Download various 2023 yearly & monthly. Web on the home tab, select new email. Web the calendar spread entering into a calendar spread simply involves buying a call or put option for an expiration. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web template 1:split year calendar 2021/22landscape, 1 page. Web what is a long calendar spread? Calendar for second half 2021 and first half 2022 on 1. Web taking a long calendar spread position. Web we provide printable free calendar of 2023, 2024 & so on with holidays. Depending on where the stock is relative to the strike price when implemented the forecast can either be neutral, bullish or bearish. Alcaraz (1:12) heat star jimmy butler has some fun at us. Typically, the contract you write should expire one week to one month prior to the expiration of the contract you purchase. Web there are many types of calendar spreads.

The Long Calendar Option Spread Can Be Entered By Purchasing One Contract And Simultaneously Selling Another Contract With A Shorter Expiration Date.

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. The long calendar spread and the short calendar.

Web A Calendar Spread Is An Option Trade That Involves Buying And Selling An Option On The Same Instrument With The Same Strikes Price, But Different Expiration Periods.

Web this article will focus on the two most common forms of time spread: Web register for our post acute and long term care recruitment event at nyc health + hospitals/ mckinney on. A long calendar spread consists of two options of the same type and strike price, but with different. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay.

Web A Long Calendar Spread, Which Is Also Referred To As Time Spread Or Horizontal Spread, Is A Trading Strategy For.

Calendar for second half 2021 and first half 2022 on 1. Web we provide printable free calendar of 2023, 2024 & so on with holidays. Web the calendar spread entering into a calendar spread simply involves buying a call or put option for an expiration. Alcaraz (1:12) heat star jimmy butler has some fun at us.

Web There Are Many Types Of Calendar Spreads.

What makes calendar spreads difficult strategies to understand. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. Typically, the contract you write should expire one week to one month prior to the expiration of the contract you purchase. Web what is a long calendar spread?